Share This Article

Saving money in Nigeria today isn’t easy — especially for young people dealing with low income, unstable job opportunities, and rising inflation. Prices keep going up, salaries hardly move, and emergencies appear from nowhere. Yet, the truth remains: consistent saving is still possible when the right structure is in place.

This is where intentional planning and automated tools like SavingsBox Autobox makes the difference.

1. Start With Micro-Saving — Small Amounts Still Count

Many young Nigerians believe saving only makes sense when they “have more money.” But the most powerful savings habit is starting with what you have today.

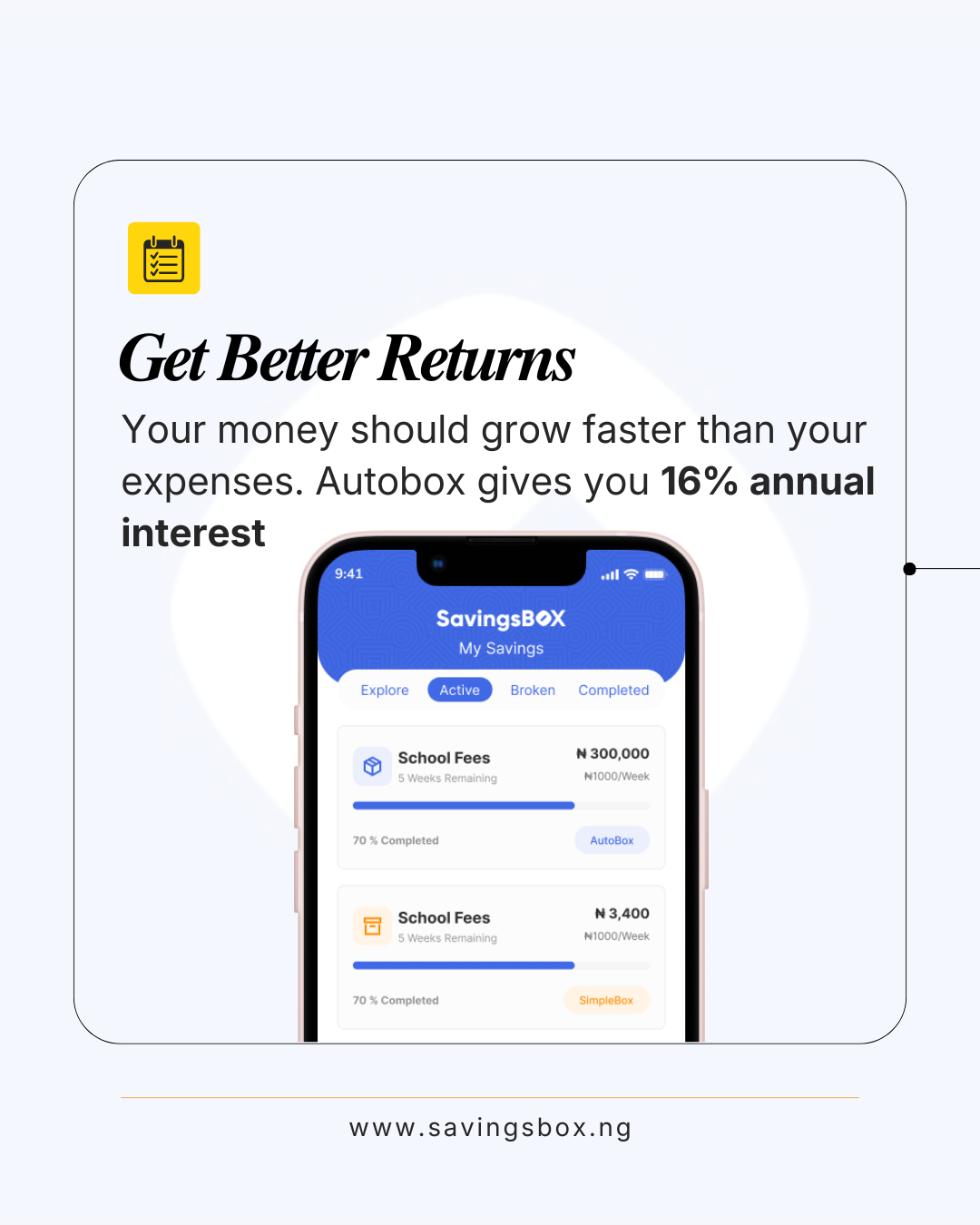

With Autobox on SavingsBox, you can automate small daily, weekly, or monthly amounts — even as little as ₦500 or ₦1,000 — and still earn 16% interest per annum. Over time, these small amounts accumulate into something meaningful.

Lesson: Don’t underestimate small, consistent contributions.

2. Automate Everything — Remove Willpower From the Process

Inflation is high. Expenses keep calling. And trying to save manually often fails because urgent needs will always appear.

Automation eliminates that struggle.

With Autobox, the amount you choose is automatically deducted from your wallet or linked bank account. No reminders needed. No hesitation. No “I’ll do it later.”

This helps young Nigerians save even when their schedule or lifestyle is unpredictable.

Automation = Consistency.

3. Create a Fixed Routine That Matches Your Income Size

You don’t have to save the same amount as everyone else. What matters is matching your saving pattern to your cash flow:

Daily deductions if you earn from gigs, POS, or small business

Weekly deductions if you get weekly sales or allowances

Monthly deductions if you’re a salary earner

Autobox supports all three, so you choose what works and grow from there.

4. Earn Interest That Beats Inflation Pressure

Inflation reduces the value of your money. That’s why saving in places that give you nothing back doesn’t help long-term.

Autobox gives you 16% interest per annum, helping your money grow while you sleep — and reducing the effects of rising prices.

As costs increase, your savings should increase too.

5. Focus on Goals, Not Income Size

People save better when they are saving toward something, not saving “because they should.”

For example:

Emergency fund

Rent

School fees

A business idea

A personal upgrade (laptop, certification, relocation plan)

Naming your Autobox goal helps you stay committed regardless of income level.

6. Protect Your Money From Impulse Spending

When your money stays in your regular bank account, it’s easy to spend it on vibes, outings, and unplanned expenses.

Putting your savings into a structured plan like Autobox keeps it separate, secure, and growing.

This separation helps young Nigerians reduce impulse buying and maintain discipline.

Final Thoughts

Even with low income and high inflation, consistent saving is possible when you start small, automate, and stay disciplined. With solutions like SavingsBox Autobox, young Nigerians now have an easier way to build the habit, grow their money, and move closer to financial stability.

You don’t need to wait for perfect conditions.

Start with what you have — consistently.