Share This Article

Managing your budget is key to achieving financial stability, especially in the changing economy of 2025. Whether you want to save for something big, invest for the future, or just spend wisely, having a solid budget helps you reach your financial goals. Here are some simple steps to get you started:

- Set Clear Financial Goals

Start by deciding what you want to achieve financially now and in the future. Whether is saving for a gadget, reaching a milestone financially, saving for a school, house, a new car, or retirement. Having clear goals will guide your budget and keep you motivated.

- Track Your Income and Spending

Knowing how much money you have and how you spend it is important. List all your sources of income and categorize your expenses. Budgeting apps can help with this. Understanding your spending habits can show you where you might cut costs.

- Create a Realistic Budget

Divide your income among necessary expenses, savings, and spending money. Make sure your budget is practical and flexible enough for unexpected costs. A good guideline is the 50/30/20 rule: spend 50% on needs, 30% on wants, and save or pay off debt with 20%.

- Explore Savingsbox Features

Savingsbox has various features to help you manage your finances:

– Savings Product: Easily create and track accounts for different goals. Whether it’s Automated savings or Targeted savings. Savingsbox is the app. And you can get up to 15% interest rate Per annum.

– Loan Products: Access flexible loans with good interest rates and you can get up to 20 Million.

– Investment Product: Explore different ways to grow your money over time with savingsbox Investibox. You can get up to 20% per annum.

– Food items Savings: Get food items at discounted rates, Pay on installment monthly and get free delivery for Abuja and Lagos residents (terms and conditions apply) with savingsbox Jolly plan.

https://dashboard.savingsbox.ng/auth/login

- Automate Your Savings

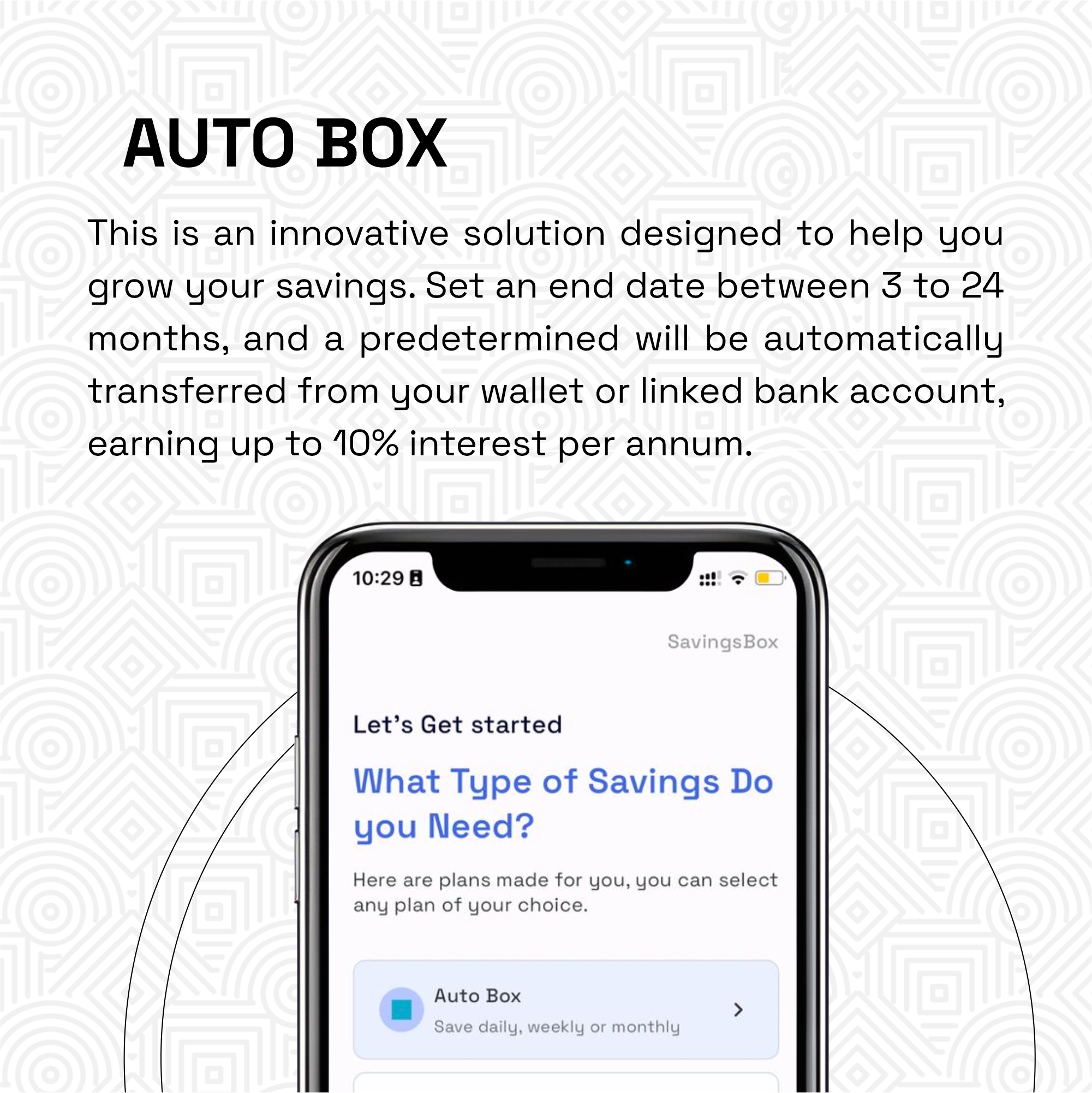

Set up automatic transfers to your savings account. This “pay yourself first” approach makes saving a priority and helps you avoid spending that money. You can set up an Autobox with Savingsbox which saves an amount daily, weekly, or monthly and you can save as low as N500 and you get 10% interest per annum on your savings.

- Review and Adjust Your Budget Regularly

Check your budget often to see how you’re doing and make changes as needed. Since life can be unpredictable, your budget should adapt to any changes in your finances or goals.

- Improve Your Financial Knowledge

Stay informed about financial trends and best practices. The more you know about managing finances, investing, and saving, the better choices you can make.

By following these steps, you can budget effectively in 2025. Remember, being consistent and flexible is vital for successful budgeting. With the right approach, you can achieve financial security and peace of mind.