Share This Article

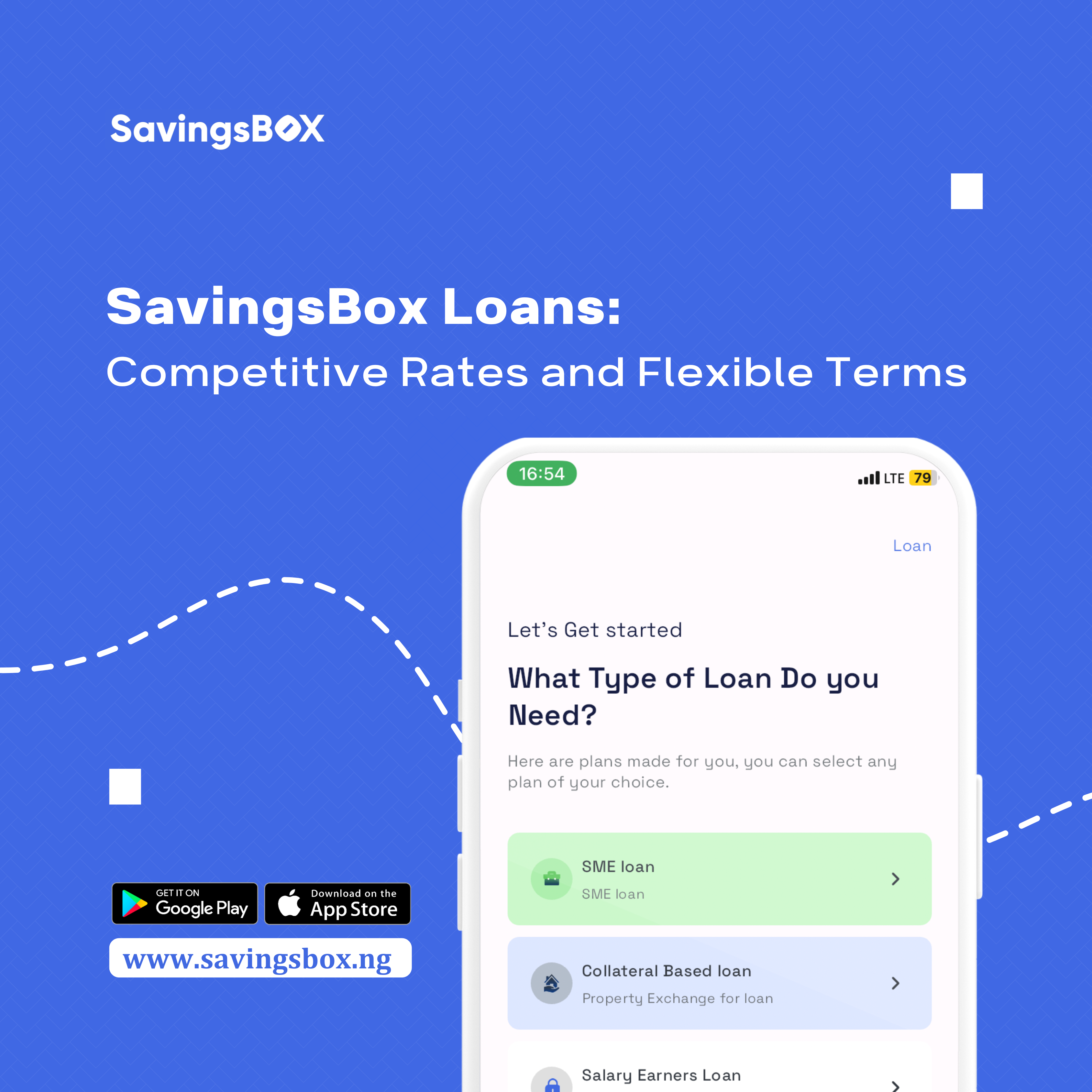

At SavingsBox, we understand the diverse needs of our clients and are committed to providing loan options that cater to a wide range of financial goals. Whether you’re a small business owner, a salary earner, or someone in need of a collateral-based loan, SavingsBox offers competitive rates and flexible terms to help you achieve your objectives. Here’s a closer look at how our loan products can work for you.

SME Loans: Empowering Small and Medium Enterprises

Small and medium enterprises (SMEs) are the backbone of any economy, driving innovation and creating jobs. However, accessing the necessary capital to start or grow a business can be challenging. SavingsBox SME loans are designed to empower entrepreneurs with the financial resources they need to thrive up to 2 MILLION NAIRA and interest rate between 5% to 15% per annum.

Key Features:

- Competitive Interest Rates: Our SME loans come with some of the most competitive interest rates (5% – 15%) in the market, ensuring you can invest more in your business without being burdened by high costs.

- Flexible Repayment Terms: We offer flexible repayment schedules that align with your business’s cash flow, allowing you to repay the loan in a way that suits your financial situation.

- Fast Approval Process: Time is money, and we ensure that our loan approval process is swift, so you can get the funds you need when you need them.

Collateral-Based Loans: Secured and Reliable Financing

For those looking for larger loan amounts , collateral-based loans are an excellent option. By securing your loan with an asset, you can often access more favorable terms.

Key Features:

- Lower Interest Rates: Because these loans are secured with collateral, they typically come with lower interest rates (6% – 18%), making them more affordable in the long run.

- Higher Loan Amounts: With collateral, you can qualify for larger loan amounts up to 20 MILLION NAIRA , giving you the financial muscle to undertake significant projects or investments.

- Flexible Collateral Options: We accept various types of collateral, including property, vehicles, and other valuable assets, providing you with multiple options to secure your loan.

Salary Earners Loans: Convenient and Accessible

For salaried individuals, wether you work in the civil service or private organizations or NGO’s unexpected expenses or major life events can create a need for additional funds. SavingsBox salary earners loans up to 2 HUNDRED THOUSAND NAIRA are tailored to provide quick and easy access to the money you need, with terms that fit your financial lifestyle.

Key Features:

- Simple Application Process: Our application process is straightforward and can be completed online, ensuring minimal hassle.

- Competitive Interest Rates: We offer favorable interest rates for salary earners (5% – 15%), making our loans an affordable solution for your financial needs.

- Flexible Repayment Plans: Repayment terms are designed to align with your salary schedule, ensuring that you can repay your loan comfortably without straining your finances.

At SavingsBox, we are dedicated to providing loan products that meet the diverse needs of our clients. With competitive rates and flexible terms, our SME loans, collateral-based loans, and salary earners loans offer practical solutions to help you achieve your financial goals. Whether you’re looking to grow your business, secure a large loan with collateral, or cover personal expenses, SavingsBox is here to support you every step of the way.

Apply for a SavingsBox loan today and take the first step towards unlocking your financial potential. Visit www.savingsbox.ng or call 08171777733 to get started